Swap Fee

Swap fee refers to the operation of transferring a trader's position to the next trading day. This operation is executed at the end of the trading day, provided that the position remains open. A fee is charged for transferring the position. The swap fee amount is accumulated in a separate field for each open position. Once the position is closed, the accumulated swap fee will be included in the balance.

-

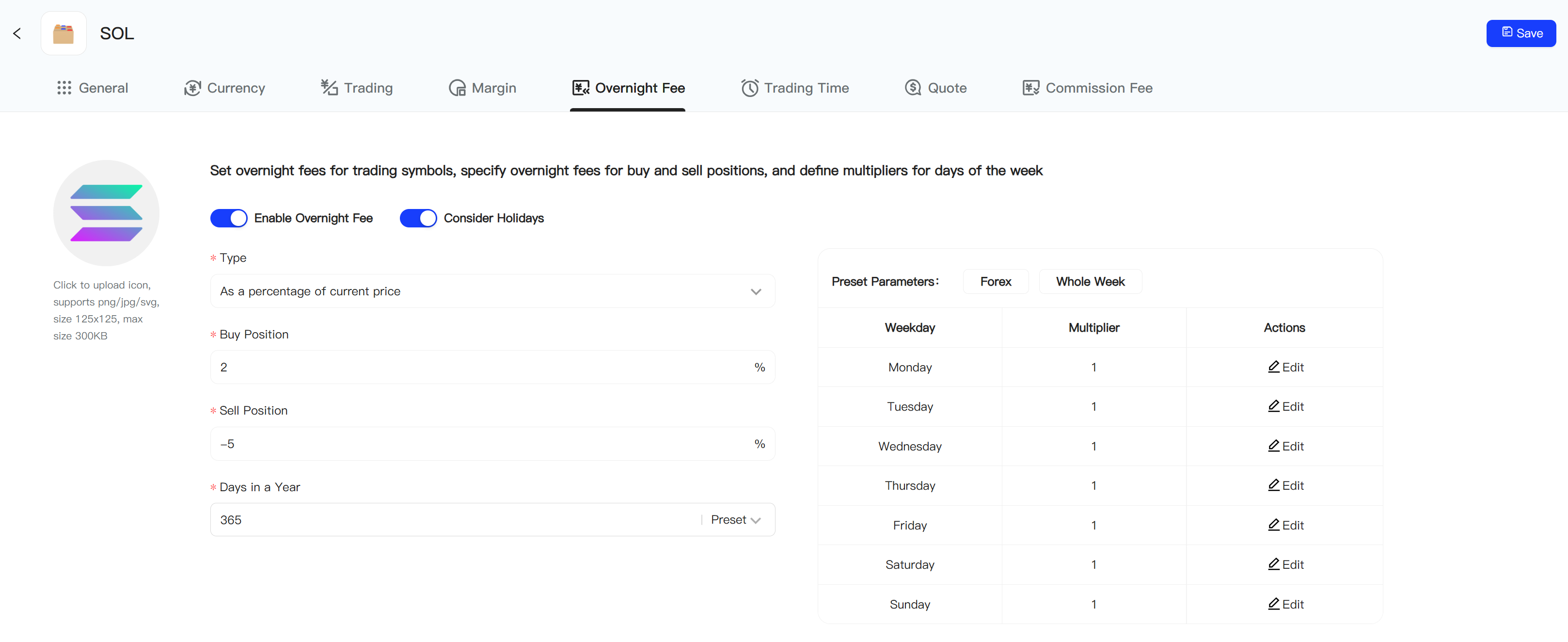

Enable Swap Fee – Enable/Disable the charge of swap fees.

-

Type – The type of swap fee applied.

-

Buy Position Swap Fee – The swap fee for holding a buy position.

-

Sell Position Swap Fee – The swap fee for holding a sell position.

-

Days in a Year – The number of days used to calculate the annual swap fee percentage. Depending on the country and market in which the broker operates, as well as the type of trading symbol, different values can be used for calculating the annual percentage. By default, 360 days is used, but this can be changed to 365 or 366, or a custom value can be specified.

-

Swap Multiplier – The multiplier applied to the swap fee for each day of the week. This multiplier is used to adjust the swap fee value calculated before charging. A value of 1 applies the normal fee, 3 represents triple the swap fee, and 0 cancels the swap fee.

You can use the preset buttons above for convenient configuration:

- Forex – Standard settings for forex symbols: the regular swap fee for weekdays and triple swap fee on Wednesdays.

- Entire Week – The standard single swap fee for all 7 days of the week.

:::

- Type 1

- Type 2

- Type 3

Per Point Charge

The swap fee amount is set per point and calculated using the following formula:

Swap Fee Amount * Point Price

Depending on the position direction, the swap fee amount is retrieved from the "Buy Position Swap Fee" or "Sell Position Swap Fee" fields. The calculation is performed in the following order:

Considering Position Volume, Calculating Point Price in the Trading Symbol's Profit Currency

-

Convert the obtained price to the client's deposit currency.

-

Use the above formula to calculate the total swap fee amount.

-

The point price represents the profit from a one-point movement in the price of a position with a specified trade volume. The price is calculated based on the trading symbol's profit calculation (depending on the position direction), including conversion to the deposit currency.

For example, suppose we buy 5.00 USDTRY, with a contract size of 100,000, and the profit calculation type is Forex. The point price calculation is as follows:

5 * 100 000 * 0.00001 = 5 TRY

If the deposit currency is USD, the price is converted at the current exchange rate:

5 * 0.2274587 = 1.14 USD (rounded)

If the swap fee for the buy position is -11.35, the total amount is calculated as:

1.14 * (-11.35) = 12.94 USD

Charge Based on Current Price Percentage

In this case, the swap fee is calculated as a percentage of the current position cost:

(1 lot position cost * trade volume in lots * specified swap size / 100) * 360;

Charge Based on Opening Price Percentage

In this case, the swap fee is calculated as a percentage of the position cost at the time of opening:

(1 lot position cost * trade volume in lots * specified swap size / 100) * 360.